Legalized Sports Betting in NJ, a Rose With a Few Thorns

By Jane Bokunewicz, Ph.D. - Professor of Hospitality and Tourism Management Studies, and Faculty Director of the Lloyd D. Levenson Institute of Gaming, Hospitality and Tourism, Stockton University

LIGHT was invited to provide testimony at a joint hearing of the Assembly Tourism, Gaming & the Arts and the Senate State Government, Wagering, Tourism, and Historic Preservation committees on Oct. 24, 2024, on the topic of “Online Sports Betting and Its Impact on the State.” Other parties invited to speak included representatives from Draft Kings, the Chamber of Commerce of Southern NJ, the NJ Council on Compulsive Gambling, Rutgers University and the NCAA. While sports betting is an important revenue and tax generator for NJ and provides an exciting activity for participants, it also creates challenges in ensuring responsible gaming. Below is a summary of LIGHT’s testimony.

Jane Bokunewicz, Ph.D.

Professor of Hospitality and Faculty Director of LIGHT,

Stockton University

Sports wagering revenue has been growing steadily since its inception in 2018 to over $1 billion dollars, an increase of almost 32% year over year in 2023. Sports wagering is clearly a popular form of gaming entertainment for state residents with more than $45 billion in handle, which represents the amount wagered on the activity, generating over $3 billion in gross gaming revenue and more than $400 million in state tax revenue.

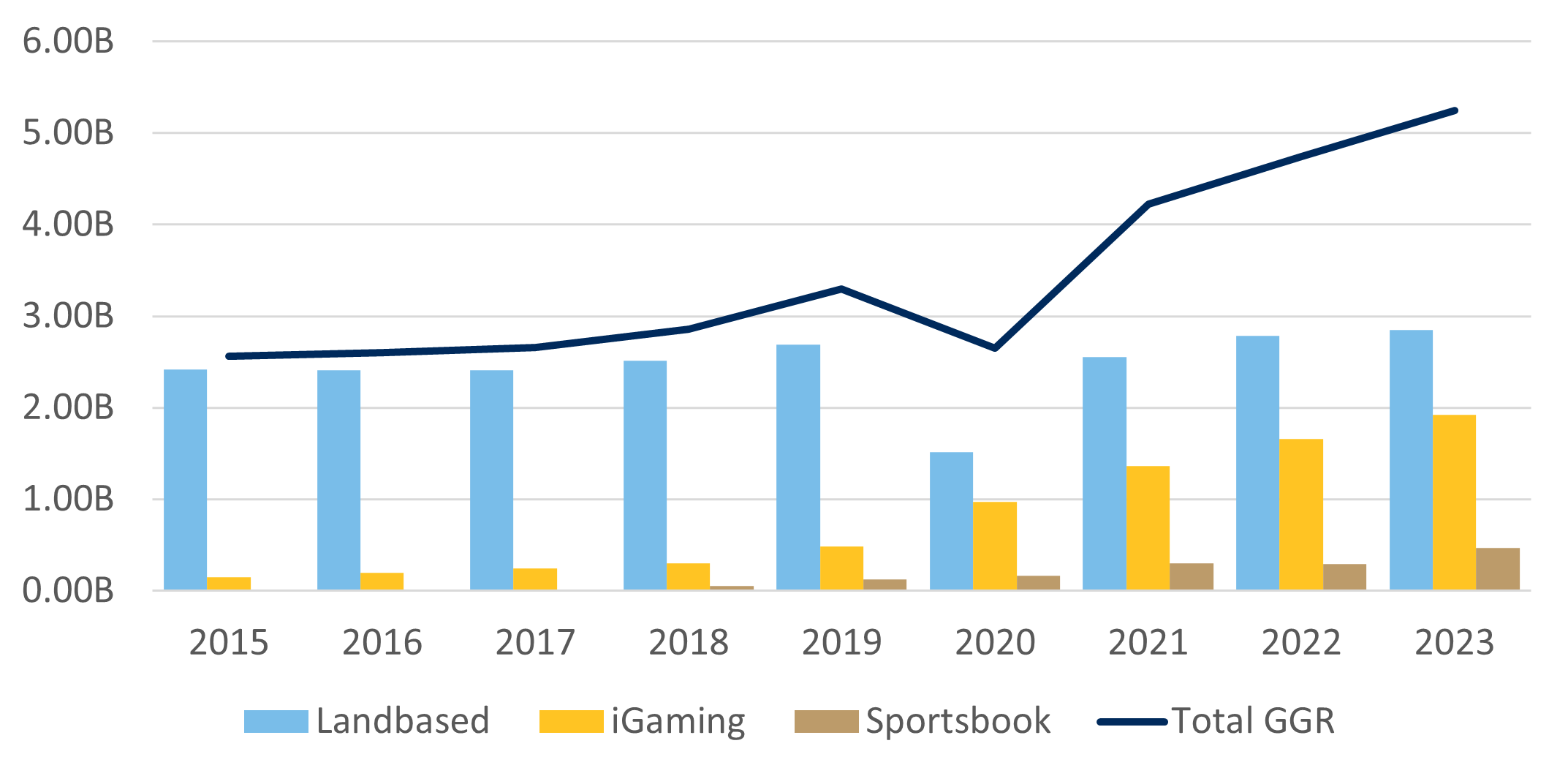

While total gross gaming revenue at Atlantic City casinos has been growing steadily

as represented by the black line on the chart below, land-based revenue at the casinos

has been relatively flat since 2015 represented by the blue bars on the chart. Internet

gaming in gold and sports wagering revenue in brown have contributed the most to the

revenue growth. With the growth of these two emerging segments, total gross gaming

revenue has returned to 2006 levels, which was a peak year for the city.

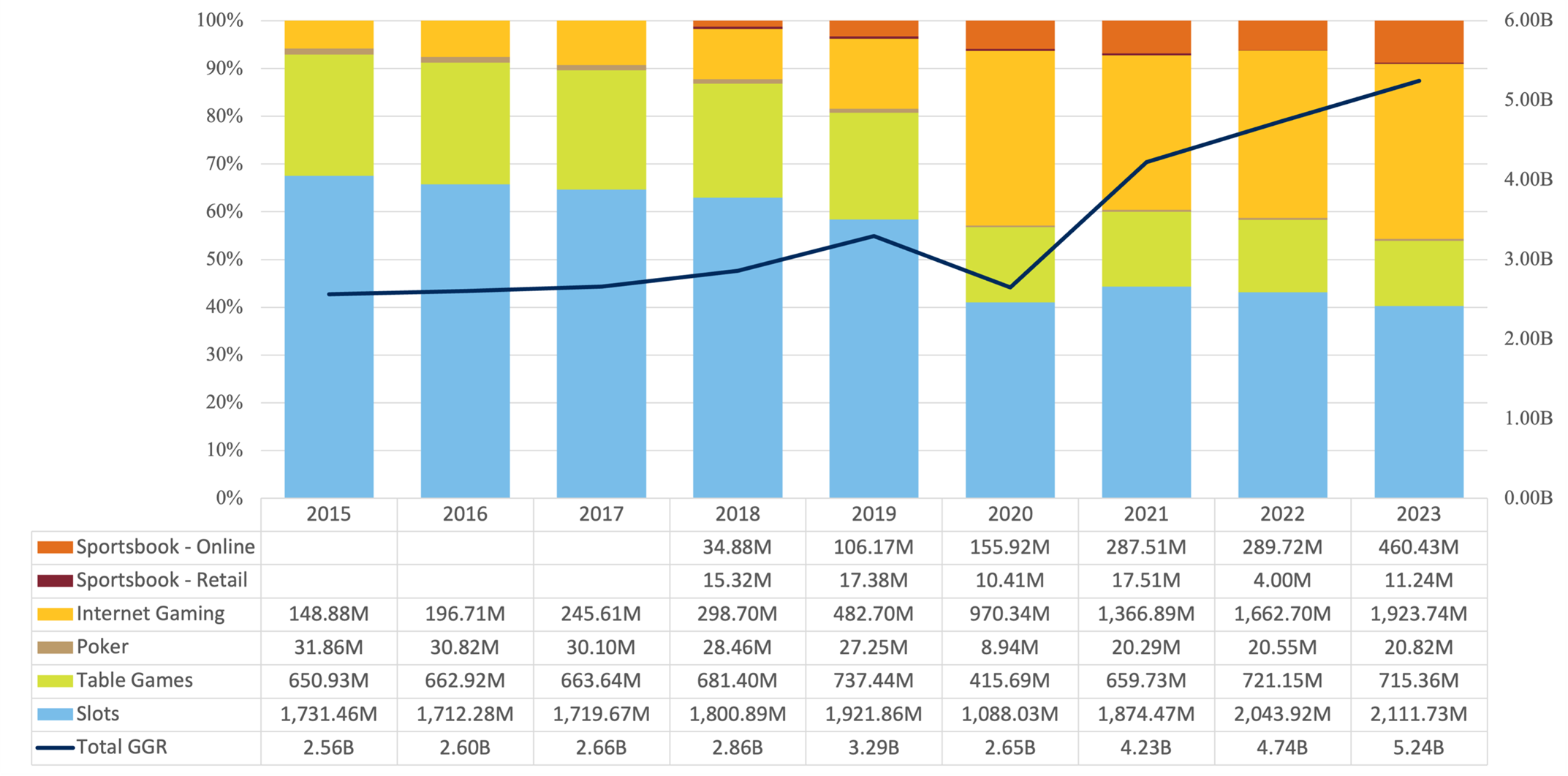

As a percent of total revenue, slots and table games represented in blue and green

on the chart below, still contribute the most at just more than 50%, but internet

gaming and sports wagering revenue in gold and orange are increasingly more important

as a revenue stream. The internet gaming and sports betting segments could potentially

surpass slots and tables if this growth rate continues. Although sports wagering is

a small percentage of total gaming revenue, it has grown in importance from just over

1% of the total in 2018 to almost 8% in 2024.

New Jersey sports betting revenue at both the casinos and racetracks combined has

the highest growth rate YTD as of July 2024 at 30%. Traditional gross gaming revenue

at slots and tables decreased by 1% YTD as of July. New Jersey is in line with national

trends. Nationwide, sports betting has grown 30%, while traditional casino gross gaming

revenue has grown only .1%, which is in effect flat. Sports wagering revenue at NJ

racetracks has the highest growth rate at more than 40%, compared to casino sports

wagering, which grew almost 17%.

One benefit to the state because of the legalization of sports betting is the direct and indirect jobs that were created. Examples of direct jobs include Oddsmakers, Sportsbook Operators, Customer Service Representatives and Risk Analysts. Indirect jobs include Hospitality, Security, Finance, Technology and Cybersecurity for example.

The number of jobs created by sports betting in NJ is not available through public information, however a representative from the NJ Division of Gaming Enforcement estimates that about 4,000 jobs were created in the state by igaming and sports betting, and that number is expected to grow as N.J. is focusing on making the state a hub for sports betting and Igaming operations.

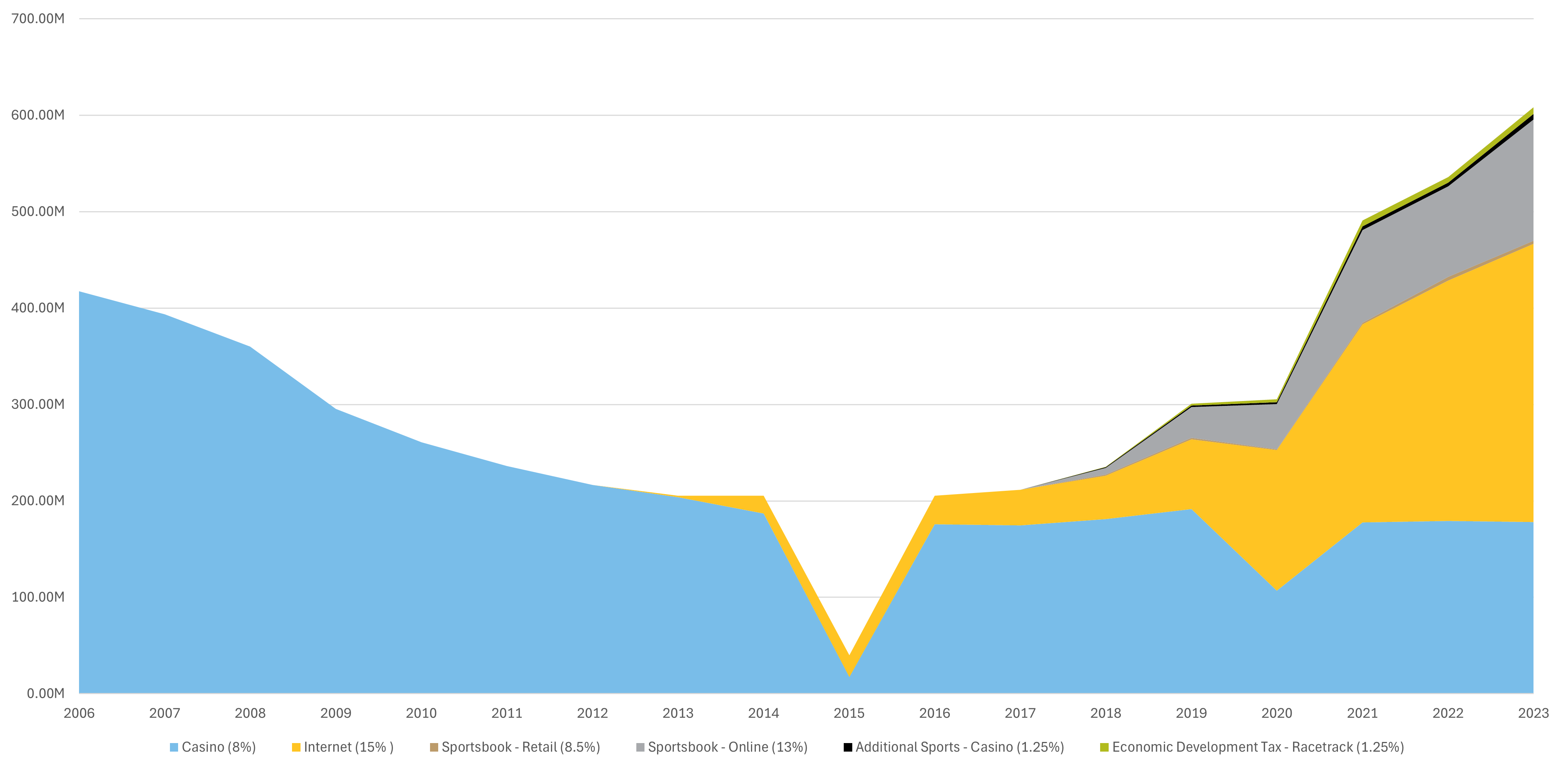

Online sports betting revenue and internet gaming revenue are taxed at a higher rate than in-person casino revenue. So, the contribution to state taxes has grown significantly with the growth of these two segments. At $608 million in total state taxes, 2023 was a record year -- significantly more than the industry’s peak in 2006. Sports betting alone contributed $141.5 million in state taxes. The blue on the chart below represents taxes generated from in-person gaming. Without internet and sports betting, the state could have potentially experienced a continued decline in tax revenue. Taxes from the casino revenue fund are used to support important state programs like assistance for seniors and housing programs for people with developmental disabilities.

Several new research studies have been published that attempt to measure the social impact of the legalization of sports betting. The Baker Study from Northwestern University reviewed actual deposits and withdrawals of individual sports better. They found higher credit card balances, reduced deposits in equity accounts and lower credit scores. The Hollenbeck study from UCLA looked at states on a macro level. They found lower credit scores, and increased bankruptcies and car loan defaults in states where sports betting was legalized.

The Fairleigh Dickinson Poll in New Jersey found an increase in problem gambling among young men compared to the general population. 10% of men aged 18 -20 experienced problem gambling as measured by the problem gambling severity index, compared to 3% of the general population. A higher percentage of young men bet on sports online at 26% compared to 10% of the general population. FDU also found a higher percentage of online sport bettors who report one or more problem behaviors compared to those who play the lottery or gamble in person in the casinos.

the legalization of sports betting has moved the activity from the illegal market where it could not be tracked into the legal market where it is regulated..."

On the positive side, the legalization of sports betting has moved the activity from the illegal market where it could not be tracked into the legal market where it is regulated, and protections can be put in place. According to the American Gaming Association research, sports bettors overwhelmingly (90%) say it is important for the industry to be legal and regulated. 88% of sports bettors feel the industry is committed to responsible gaming and 85% agree with the effectiveness of responsible gaming programs. Bettors are familiar with at least one responsible gaming resource and 57% reported seeing increased responsible gaming messaging.

In summary, online sports betting is growing in popularity, and it is helping to offset the slowing of growth in in-person gross gaming revenue. It is an important tax revenue stream for N.J., which would have potentially experienced declining tax revenue if not for online sports betting and internet gaming tax revenue. Recent studies have found areas of concern in increased problem gambling behavior, especially among younger men and indications of reduced financial health in states where it is legalized. The public appreciates the legalization and regulation of the industry, and most are aware of resources for people experiencing problem gambling behavior.