New Jersey Gaming Tax Increases: Picking the low hanging fruit or killing the golden goose?

By Sarah Grady, MA, Assistant Director of the Lloyd D. Levenson Institute of Gaming, Hospitality and Tourism, Stockton University

An increased tax rate for certain gross gaming revenue

On June 30, 2025, New Jersey legislators passed Assembly Bill 5803 which “modifies tax on certain forms of online gaming and wagering.” The bill was signed into law, among other provisions, as part of the State of New Jersey’s Fiscal Year 2026 budget.

Sarah Grady, MA

Assistant Director of the Lloyd D. Levenson Institute of Gaming,

Hospitality and Tourism, Stockton University

The law as enacted specifies a 19.75% tax on gross revenues earned from online sports wagering, daily fantasy sports (DFS), and internet gaming by casinos, racetracks and their partners. This rate is less than the 25% initially proposed in The State of New Jersey Budget in Briefreleased in February 2025 (p.58), but more than the previous tax rates of 13%, 10.5% and 15%, respectively. For reference, the tax rates on land-based gaming activities have not changed – 8% for traditional casino games and 8.5% for retail sportsbooks – and additional/investment alternative taxes also remain in effect.

Although the 19.75% tax rate represents a notable increase for New Jersey gaming operators, it is still relatively low compared to internet gaming taxes levied nationwide, and in the mid-range of taxes currently levied on sports wagering in other gaming jurisdictions. The increase is also on trend with other gaming jurisdictions across the country that have been revisiting gaming tax rates in recent months with several opting for increases.

The new rate in context

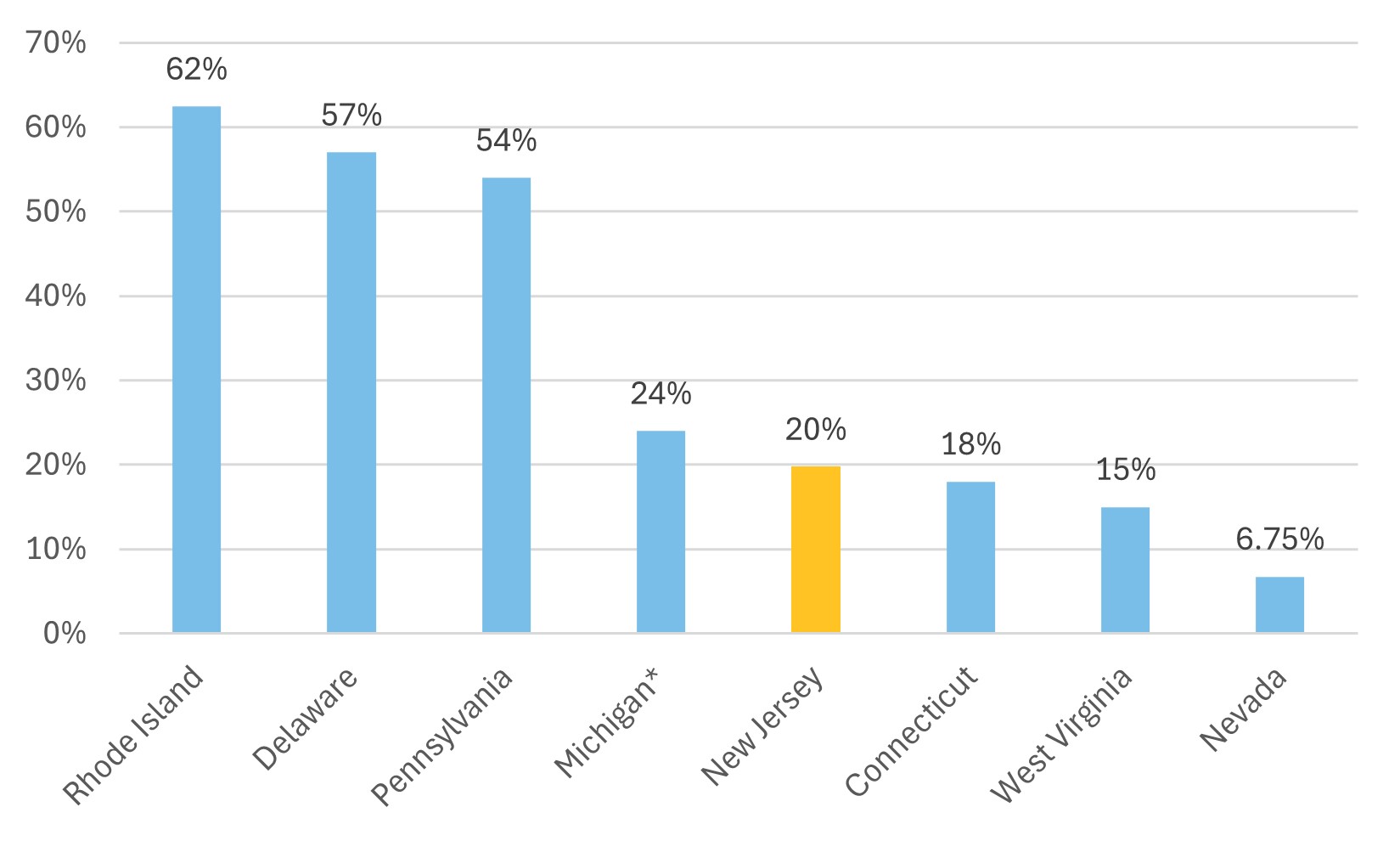

Table one: Online Slot Games Tax Rates

All legal states, as of December 31, 2024

* Michigan uses a tiered tax rate ranging between 20-28% based on total revenue

Source: American Gaming Association, State of the States 2025 (pg. 22)

According to the American Gaming Association, just eight jurisdictions currently offer internet gaming. At 6.75%, 15% and 18% respectively, only Nevada, West Virgina and Connecticut have lower tax rates for internet gaming than New Jersey.

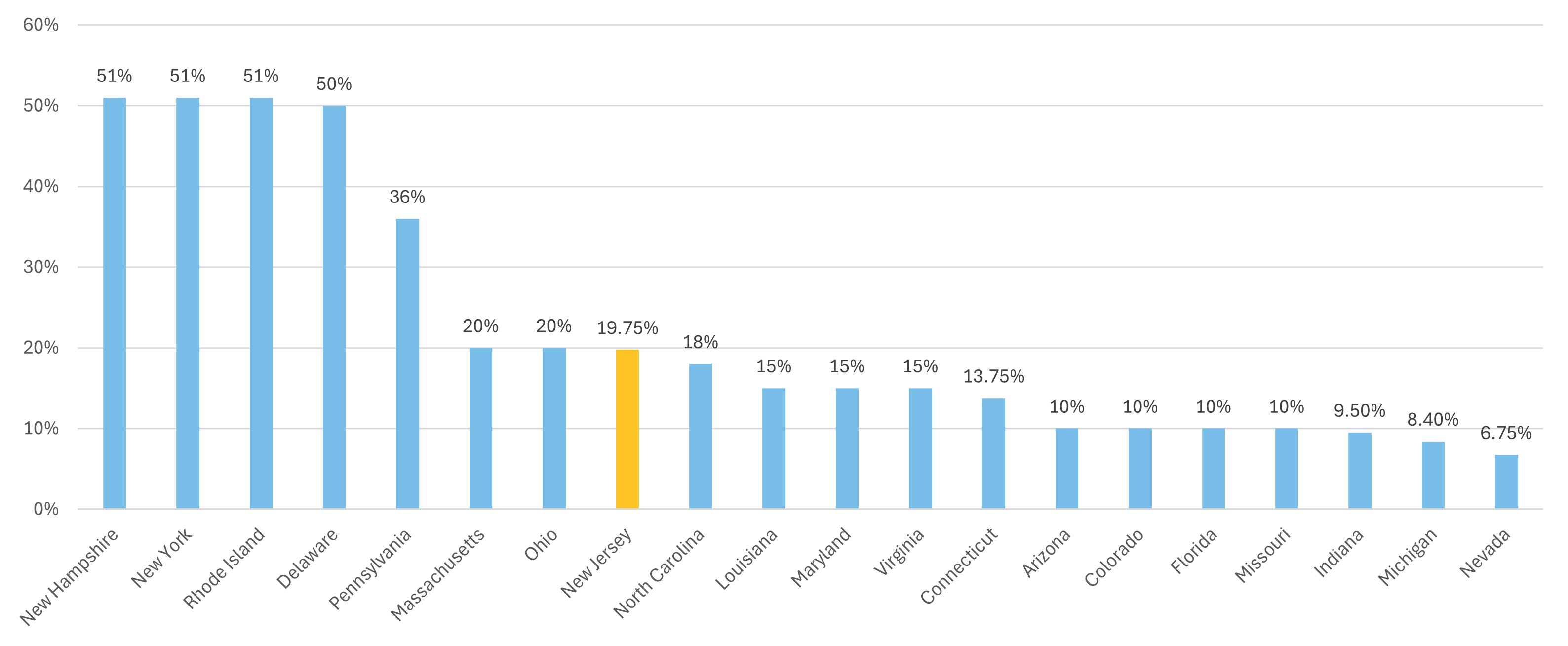

Online Sports Wagering Tax Rates

Select states as of June 25, 2025

Source: Betting USA

Among the 40 jurisdictions with some form of legal sports wagering, New Jersey’s new tax rate sits comfortably in the middle and, with neighboring Pennsylvania (36%), Delaware (50%), and New York (51%) levying much higher taxes on sports wagering, it would seem to still be competitive regionally.

Increased revenue for New Jersey

As shared by Legal Sports Report, Barry Jonas, an analyst at Truist, estimates that if the new tax rate were applied to the last 12 months of gaming revenues (as of June 2025) the State of New Jersey would have seen an additional $172 million in tax revenue in fiscal year 2025. The largest share of this increase would have been paid by FanDuel ($67 million) and DraftKings ($56 million). Once in effect, we should expect the new tax rate to generate a similar amount to this annually moving forward. These funds will continue to be directed to the Casino Revenue Fund, which is used to finance support programs for some of New Jersey’s most vulnerable residents.

Potential impacts

The impacts of the tax increase are likely to be balanced between patrons and operators as the industry adjusts to the change. One impact that might be seen in the near term is the amount of promotions offered to patrons. By reducing promotions alone, Jonas believes New Jersey gaming operators can mitigate the impact of the increased tax rates by approximately 20% to close out calendar year 2025 and by about 50% in calendar year 2026.

Operators may also opt to pass the expense on to consumers. For an example of this look to Illinois. As part of that state’s fiscal year 2025 budget, Illinois introduced a tiered tax on sports wagering of 20-40%, based on adjusted gross revenue. This in addition to a 2% tax levied on sportsbook operators in Chicago and Cook County. Operators already felt that the tax environment in high-tax states like Illinois (states with tax rates of greater than 20%) threatened the industry’s profitability, but the per-bet tax on sports wagering implemented July 1, 2025, seems to have pushed things to a tipping point. FanDuel and DraftKings the market’s largest operators have responded by introducing transaction fees or “surcharges” for their Illinois transactions, while other operators have introduced minimum bet thresholds of $2.00 – 2.50 in response.

Of note, a June 2025 assessment from Fitch Ratings found that “recent and proposed state sports betting tax hikes could dampen the online

gaming sector’s positive growth momentum but is unlikely to affect the ratings for

online gaming operators DraftKings (DKNG; BB+/Stable) and Flutter Entertainment (Flutter,

FanDuel, BBB-/Stable).”

Internet gaming and sports wagering represent an ever-increasing share of total gross gaming revenue, and any action impacting the segment’s profitability for operators is likely to have an effect on the industry as a whole."

What’s next?

The tax increase comes at an interesting time for New Jersey’s gaming industry. Internet gaming, catalyzed by the casino closures in response to the COVID-19 pandemic, has grown considerably in recent years and appears to be continuing an upward trend – making it ripe for such a reassessment. Meanwhile, traditional, land-based casino revenues have shown evidence of post-pandemic stabilization and modest growth that may or may not be sufficient to insulate Atlantic City operators from competition with downstate New York casino expansion, which is eminent.

Internet gaming and sports wagering represent an ever-increasing share of total gross gaming revenue, and any action impacting the segment’s profitability for operators is likely to have an effect on the industry as a whole. How significant an effect is hard to say. With these tax increases the state may be looking to "pick the low hanging fruit" – leveraging the industry’s success to help balance the state budget. But there is a risk, however small, that the increased pressure on gaming operators and their partners may "kill the golden goose" – forcing operators to make changes (like surcharges and other increased expenses to consumers) that are likely to alter player behavior and industry profitability.

References

American Gaming Association. (2025). State of the States. Retrieved August 4, 2025, from https://www.americangaming.org/wp-content/uploads/2025/05/AGA-State-of-the-States-2025.pdf

American Gaming Association. (n.d.). State of Play Map. Retrieved July 16, 2025, from https://www.americangaming.org/research/state-of-play-map/

Draft Kings. (2025, June 12). DraftKings to Introduce Transaction Fee in Illinois. Press Release. Retrieved from https://draftkings.gcs-web.com/news-releases/news-release-details/draftkings-introduce-transaction-fee-illinois

Fitch Ratings. (2025, June 16). U.S. Online Gaming Operators Resilient Amid Tax Hikes. Retrieved from FitchRatings.com: https://www.fitchratings.com/research/corporate-finance/us-online-gaming-operators-resilient-amid-tax-hikes-16-06-2025

Flutter. (2025, June 10). Flutter response to Illinois Transaction Fee. Press Release. Retrieved from https://www.flutter.com/news-and-insights/press-releases/flutter-response-to-illinois-transaction-fee/

Garcia, J. (2025, July 15). BetMGM to Roll Out $2.50 Minimum Wager in Illinois on Wednesday. Gambling News. Retrieved from https://www.gamblingnews.com/news/betmgm-to-roll-out-2-50-minimum-wager-in-illinois-on-wednesday/

Murphy, P. D. (2025, February). The Governor’s FY 2026 Budget: Budget in Brief. Retrieved from www.nj.gov: https://www.nj.gov/treasury/omb/publications/26bib/BIB.pdf

Office of New Jersey Governor, Phillip D. Murphy. (2025, June 30). Governor Murphy Signs Fiscal Year 2026 Budget into Law. Retrieved from https://www.nj.gov/governor/news/news/562025/approved/20250630d.shtml

Parry, W. (2025, June 24). State will lessen tax hikes on internet and sports betting to 19.75% instead of 25% Murphy wanted. The Press of Atlantic City. Retrieved from https://pressofatlanticcity.com/news/local/casinos/article_d643671b-1da6-41d0-babb-8f02e4eac655.html

Ruddock, S. (2025, June 25). Sports Betting Tax Rates and Licensing Fees. Retrieved from Betting USA: https://www.bettingusa.com/sports/taxes-and-licenses/

Waters, m. (2024, August 1). DraftKings Passing Tax Burden To Bettors With Planned Surcharge On Wagers. Legal Sports Report. Retrieved from https://www.legalsportsreport.com/194473/q2-report-draftkings-passing-taxes-to-customer-with-proposed-surcharge/

Waters, M. (2025, June 30). NJ Online Casino, Sports Betting Tax Rate Increases Pass Both Chambers. Legal Sports Report. Retrieved from https://www.legalsportsreport.com/236940/nj-online-casino-sports-betting-tax-rate-increases-pass-both-chambers/